Setup

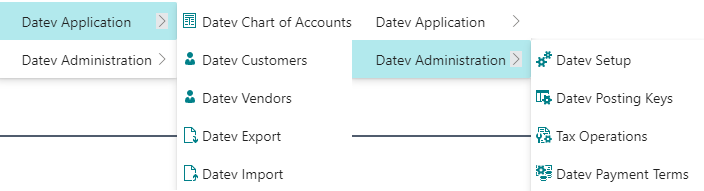

Menu

The menu is divided into two sections "Application" & "Administration".

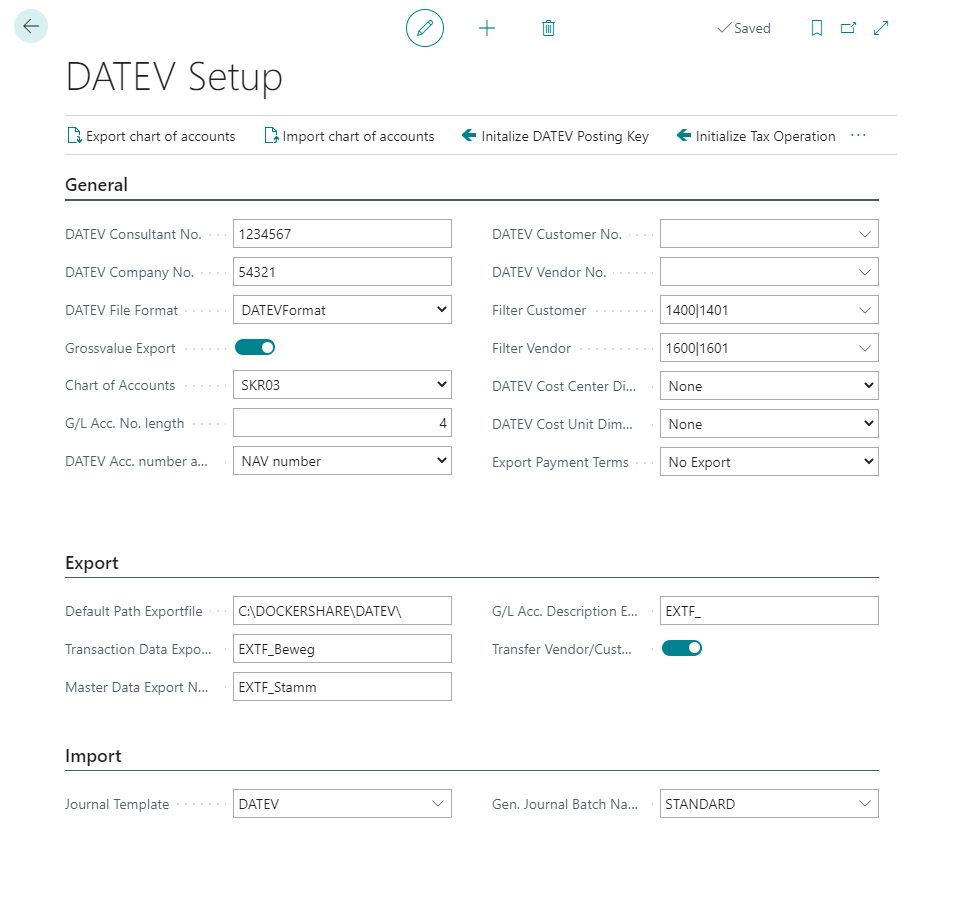

Page DATEV Setup

The DATEV Setup page is divided into the General, Export & Import tabs.

Menu options

The NAV chart of accounts can be initialized via the menu item "Initialize chart of accounts". Thereby those accounts are marked as "DATEV automatic accounts" which are marked as such in the DATEV standard charts of accounts SKR03 or SKR04. As a rule, the procedure must be carried out only once during the system setup.

The NAV chart of accounts can be initialized via the menu item "Initialize chart of accounts". Thereby those accounts are marked as "DATEV automatic accounts" which are marked as such in the DATEV standard charts of accounts SKR03 or SKR04. As a rule, the procedure must be carried out only once during the system setup.

What is a DATEV automatic account?

Automatic accounts have a program function in DATEV which causes the VAT to be calculated from the gross amount of the entry on the DATEV side. The DATEV program posts the amount reduced by the tax to the automatic account.

Builds the initial structure of the DATEV posting key table for the chart of accounts 03/04 and assigns the posting groups. After initializing, the entered posting groups must be checked for existence and the posting matrices must be adjusted accordingly! see also page DATEV posting key

Builds the initial structure of the DATEV posting key table for the chart of accounts 03/04 and assigns the posting groups. After initializing, the entered posting groups must be checked for existence and the posting matrices must be adjusted accordingly! see also page DATEV posting key

Via the menu item "Initialize DATEV posting keys" the table Control types are filled initially. see also page Tax Operations

Via the menu item "Initialize DATEV posting keys" the table Control types are filled initially. see also page Tax Operations

Reset the indicators in the person accounts to initial so that the person accounts are transferred as "New" during the next transfer.

Reset the indicators in the person accounts to initial so that the person accounts are transferred as "New" during the next transfer.

Via the menu item "Reset Customer/Vendor DATEV-No." the DATEV account number is determined according to the setup "DATEV account number assignment". Only Accounts with the DATEV No. empty are taken into consideration. This function is usually only executed initially during system setup.

Via the menu item "Reset Customer/Vendor DATEV-No." the DATEV account number is determined according to the setup "DATEV account number assignment". Only Accounts with the DATEV No. empty are taken into consideration. This function is usually only executed initially during system setup.

General

| Fields | Description |

|---|---|

| DATEV Consultant No. | The consultant number is assigned by DATEV and refers, e.g., to a tax consultant. The input can be max. 7-digit numeric. |

| DATEV Company No. | The client number is assigned by the tax consultant himself. This number can be stored numerically with a maximum of 5 digits. |

| DATEV File Format | The available format is the DATEV format. |

| Transfer Gross Tax Values | Define here if the export should be done via gross export (tax compression). With the gross export no separate tax line will be exported, per primary posting the gross amounts and the corresponding DATEV posting key will be exported. In the other procedure, a separate posting line for the tax posting is generated for each posting with tax. (Usually, the DATEV system expects the gross export procedure). |

| Chart of Accounts | Define here which chart of accounts it is in your NAV system. (Depending on the selected chart of accounts the DATEV interface can support the initialization of the accounts - see also "Initialize chart of accounts"). |

| G/L Account No. Length | Specify how many digits (4 or 6) your account numbers have. |

| DATEV account number assignment | Define here if and how the DATEV account number assignment for debtors and creditors should be done. When creating new customers and vendors in NAV, different DATEV account numbers can be generated according to the following logic:

|

| DATEV Customer No. | Number range, from which the DATEV personal account number is to be determined. Depending on whether DATEV account numbers are to be assigned automatically (see DATEV Account Number Assignment), they can also be maintained manually in the respective customers/vendors. The procedure is the same for customers and vendors. On the "DATEV" tab of the respective account, the "DATEV personal account number" can be assigned manually. |

| DATEV Vendor No. | (See DATEV accounts receivable no.) |

| Filter Customer | The first three digits of the collective account for receivables (wildcards possible) |

| Filter Vendor | The first three digits of the collective account for liabilities (wildcards possible) |

| DATEV Cost Center Dimension | NAV dimension from which the cost center is derived during export. |

| DATEV Cost Unit Dimension | NAV dimension from which the cost object is derived during export. |

| Export Payment Terms | Indicator that controls whether and how the terms of payment of the respective entry are exported. see also Page Payment Terms

|

Export

In the Export tab you can specify where you want to save exported files. For this purpose, the path of the folder must be entered in the "Default path of export file" field.

In addition, you can specify the name of the exported file with the three fields "Account labels/Movement data/Personal accounts export name". The name of the export file also contains the date and time, so that previous files are not overwritten.

The fields in detail:

| Fields | Description |

|---|---|

| Default Path Exportfile | Definition of the default path where the file to be exported should be stored. Please note that "\" is always the last character at the end of the path, otherwise an error may occur during creation. |

| Transaction Data Export Name | Enter the delivery condition for "freight paid" orders here. |

| Master Data Export Name | Enter the delivery condition for "carriage forward" orders here. |

| G/L Acc. Description Export Name | Enter the name for exported G/L accounts here. |

| Transfer Vendor/Customer | Transfer of the subledger account number if the account is defined as a collective account, as in "Filter Collect. Accounts Receivable"/"Filter Collect. Vendors". |

Import

The "Import" tab contains the fields "Book sheet template/name". Default profile of the template is "DATEV" with the name profile "STANDARD".

The fields in detail:

| Fields | Description |

|---|---|

| Journal Template | Journal template for DATEV import. |

| Gen. Journal Batch Name | Journal name for DATEV import. |

Pages Customers and Vendors

DATEV

In the DATEV tab you can view or change the DATEV personal account numbers of this current account.

Bank Accounts

You can export up to 5 bank accounts per vendor and customer. Open the DATEV tab. Please tick the bank accounts to be exported accordingly.

Page Payment Terms

In the payment terms you will find a column "DATEV Code". If this field is filled and the field "Export payment terms" in the DATEV setup is set to "DATEV codes", then the DATEV code will be transferred with the transfer of the person accounts. If the "Export payment terms" field in the DATEV setup is set to "NAV codes", the value from the "Code" column will be transferred. With the setting "no export" in the DATEV setup no payment terms will be exported.

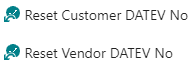

Page DATEV Posting Key

Maintenance of the DATEV Posting Keys (control keys).

The fields in detail:

| Fields | Description |

|---|---|

| DATEV Posting Key | Code for the DATEV booking key |

| EU Country/Region Code | The country code is used during import to determine the booking groups. |

| VAT Calculation Type | Indicator to limit to which VAT posting groups this posting key may be assigned. |

| Tax Category | Indicator which types of tax this key is based on. Used in the "Tax types" table to restrict the selection in the DATEV posting key fields.

|

| Gen. Bus. Posting Group | Def. business posting group for this DATEV posting key when importing from DATEV. |

| Gen. Prod. Posting Group | Def. product posting group for this DATEV posting key when importing from DATEV. |

| VAT Bus. Posting Group | Def. VAT. Business posting group for this DATEV posting key when importing from DATEV. |

| VAT Prod. Posting Group | Def. VAT. Product posting group for this DATEV posting key when importing from DATEV. |

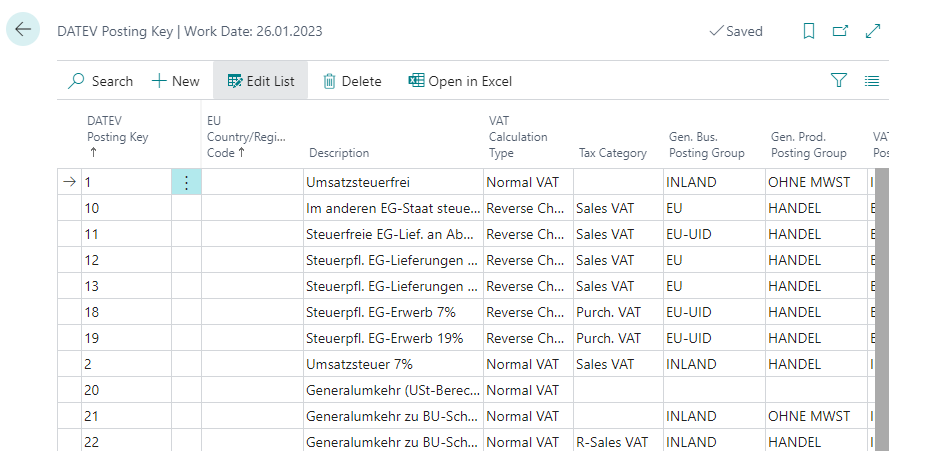

Page DATEV Tax Operation

Maintenance of tax types. The tax types are the summary of the four DATEV posting keys (input tax, sales tax, reversal input tax, reversal sales tax) for a specific tax transaction e.g. domestic 7%. The tax types are assigned to the respective transactions in the VAT posting matrix setup table and serve to simplify the assignment of the DATEV posting keys.

The fields in detail:

| Fields | Description |

|---|---|

| ID | Freely assignable code for the control type |

| EU Country/Region Code | The country code is used during import to determine the booking groups. |

| VAT Calculation Type | Indicator to limit to which VAT posting groups this posting key may be assigned. |

| DATEV Purch. Vat | DATEV posting key for the input tax transaction. |

| DATEV Sales Vat | DATEV posting key for the transaction VAT. |

| DATEV Reversal Purch. Vat | DATEV posting key for the input tax reversal transaction. |

| DATEV Reversal Sales Vat | DATEV posting key for the transaction Reverse VAT. |

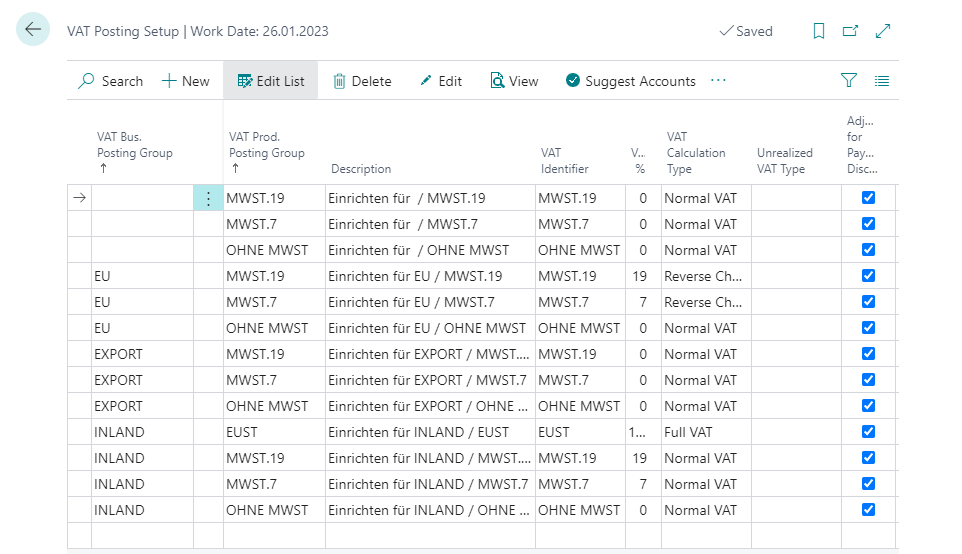

Page VAT Posting Setup

In the VAT posting matrix, the correct DATEV posting keys are assigned to the tax transactions via the tax types. To do this, select the correct tax type for each line.

The most important fields in detail:

| Fields | Description |

|---|---|

| Tax Operation | Select here the tax type for the DATEV interface that fits to this combination. |

| DATEV Purch. Vat | DATEV posting key for the input tax transaction. |

| DATEV Sales Vat | DATEV posting key for the VAT transaction. |

| DATEV R-Purch. Vat | DATEV posting key for the reversal input tax transaction. |

| DATEV R-Sales Vat | DATEV posting key for the reversal VAT transaction. |